KNOXVILLE, Tenn. — Housing affordability in the Knoxville area is at its lowest levels since the 1980s, according to a new report.

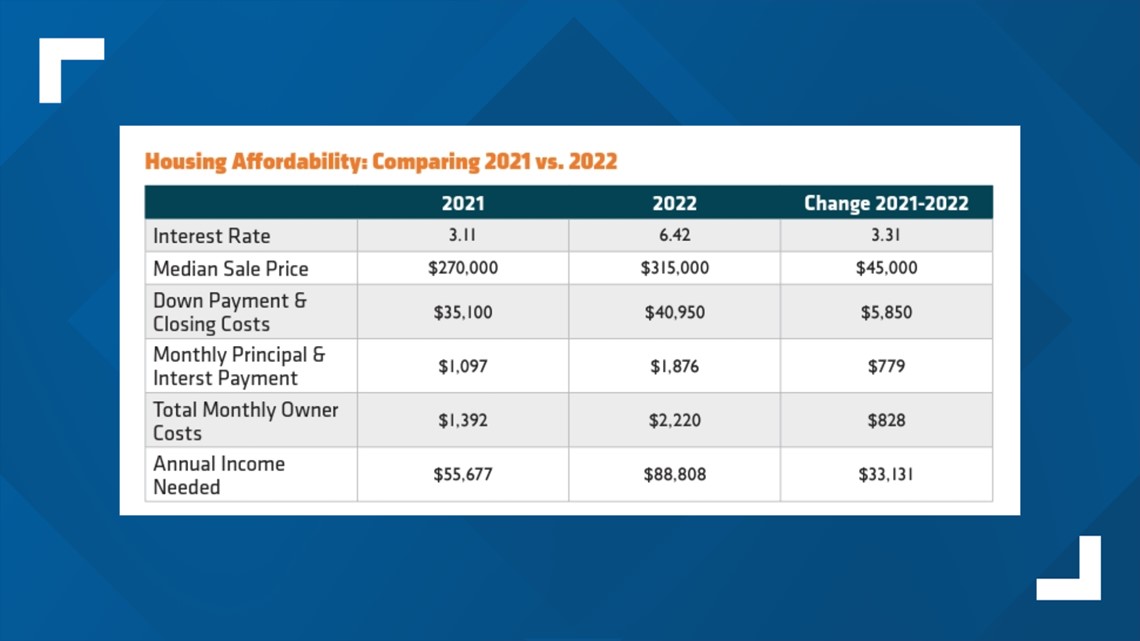

The Knoxville Area Association of Realtors released its 2023 State of Housing report on Monday. In that report, they found that in 2021, a household would need to make around $55,677 per year to afford a median-price home, which was then around $270,000. The following year, they said a household would need to make around $88,808 to afford the same median-priced home.

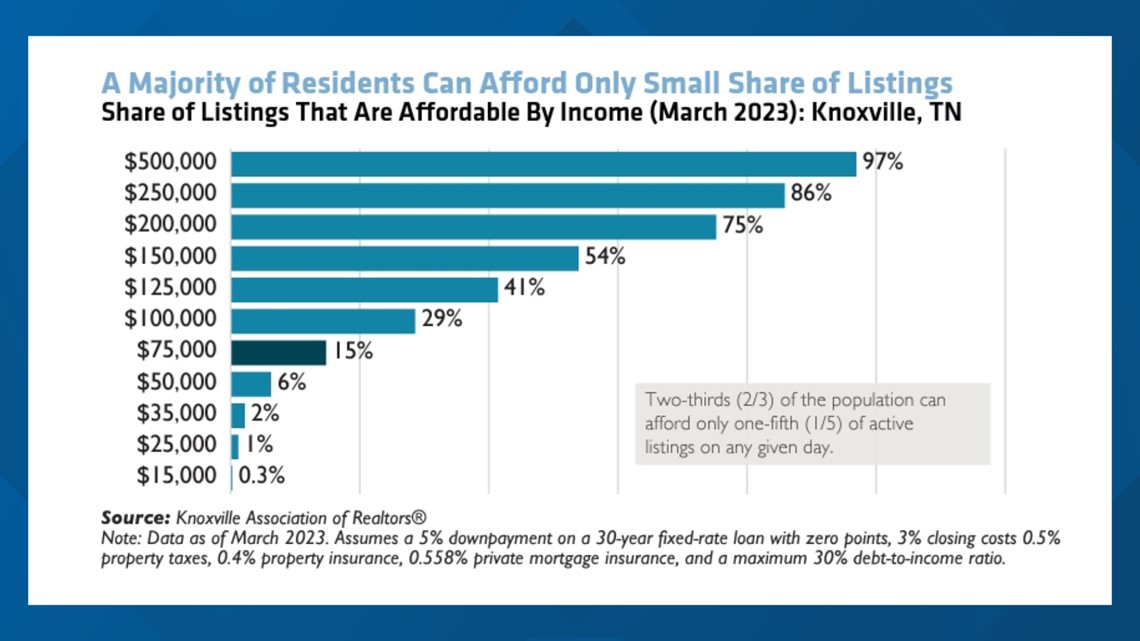

"If you make less than around $75,000, you can afford around 15% of active listings on the housing market," said Hancen Sale, who presented the report to the Knox County Commission on Friday.

They said that this year, median home prices in Knoxville crossed beyond the national median listing price, effectively calling into question whether the area can be considered an affordable area. In the fourth quarter of 2022, they said the median price in Knoxville was around $426,633. Across the U.S., it was $415,743.

The city followed a trend in metro areas across Tennessee too, with fewer active listings. Compared to 2018, Knoxville saw 68% fewer active listings in 2022. Memphis saw 60% fewer active listings, Chattanooga saw 59% fewer listings and Kingsport/Bristol says 79% fewer listings.

He said that part of the reason for fewer listings in the area is because of rising mortgage interest rates. He said that around 80% of all mortgages in Tennessee are below 5%, which can dissuade people from selling their homes and creating the "lock-in effect."

He also said many people in the state may also choose to turn their homes into rental units instead of selling, keeping a low mortgage interest rate and ownership of the home.

Sale said that on average, rental prices in Knoxville rose by around $450 on average compared to before the COVID-19 pandemic. He also said that the city's occupancy rate rose in 2022 to 98.3%, compared to 98.2% in 2021.

"Not only are we seeing more expensive rental units, but it's getting hard to find a unit at all," he said.

He also said more higher-income households are choosing to rent in the Knoxville area. He also said older people are renting more often too. Sale also said that migration to Knoxville has been from areas where renting is more common. More students were also looking for homes in the private rental market, as opposed to traditional student housing markets.

According to the report, the ratio of home prices to income in the area spiked in 2022. The report says that while the median sale price of homes rose and higher interest rates prompted higher monthly mortgage payments, wages in the area only grew by around 10.8%.

According to the report, the share of homes bought by investors rose in Knox County. They said investor purchases accounted for around 14% of home sales in 2022, an increase from 11% compared to the previous year. However, that increase did not distinguish between typical investors and "iBuyers." Most properties bought by investors cost less than typical homes bought by non-investors.

"Californians don't represent the majority of people buying here. The majority of people buying here are local. But we are attracting people from Chicago, New York and D.C.," said Sale. "But it's important to note that regional population growth is being driven almost exclusively by migration."

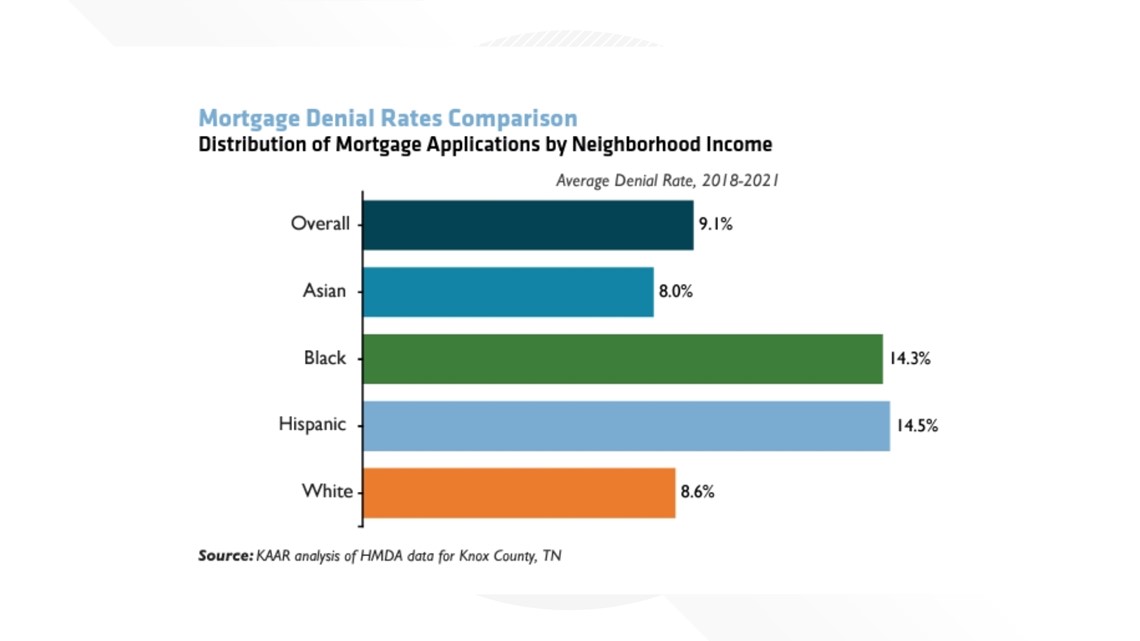

The report also revealed that Knoxville minority groups have lower homeownership rates compared to national and state levels. It also said that from 2018 to 2021, around 28.3% of all mortgage applications were from Black applicants and 20.6% from Hispanic/Latino applicants were for homes in low-income areas, compared to 15.2% from white applicants and 8.9% for Asian applicants.

It also revealed that Black applicants and Hispanic applicants had their mortgage applications denied at higher rates compared to white or Asian applicants.

The report found that home prices are expected to continue rising by between 3% and 5% next year, and home sales are expected to decline due to low inventory and affordability. Occupancy rates in Knoxville's rental market are also expected to drop to 96.6%, as more rental properties are built. However, effective rent prices are also expected to rise to $1,355, compared to $1,302 in 2022.

"If we fail to invest in our housing supply today, it will be at the expense of the economic growth and prosperity of tomorrow," Sale said. "Housing is the business cycle. If we want to continue to grow, and if we want to continue to support essential workers ... the people who keep our society and our economy going, if we want to continue to support them, we need to put our money where our mouth is."

During the meeting, a spokesperson from the Knoxville Chmaber said that housing affordability is also impacting the ability of businesses to attract a workforce and thrive in the area. He also said that students are moving further away from campus, which could impact traffic congestion.