KNOXVILLE, Tenn. — The housing market in Knoxville is still getting hotter and hotter — but one local expert there are signs of hope for buyers.

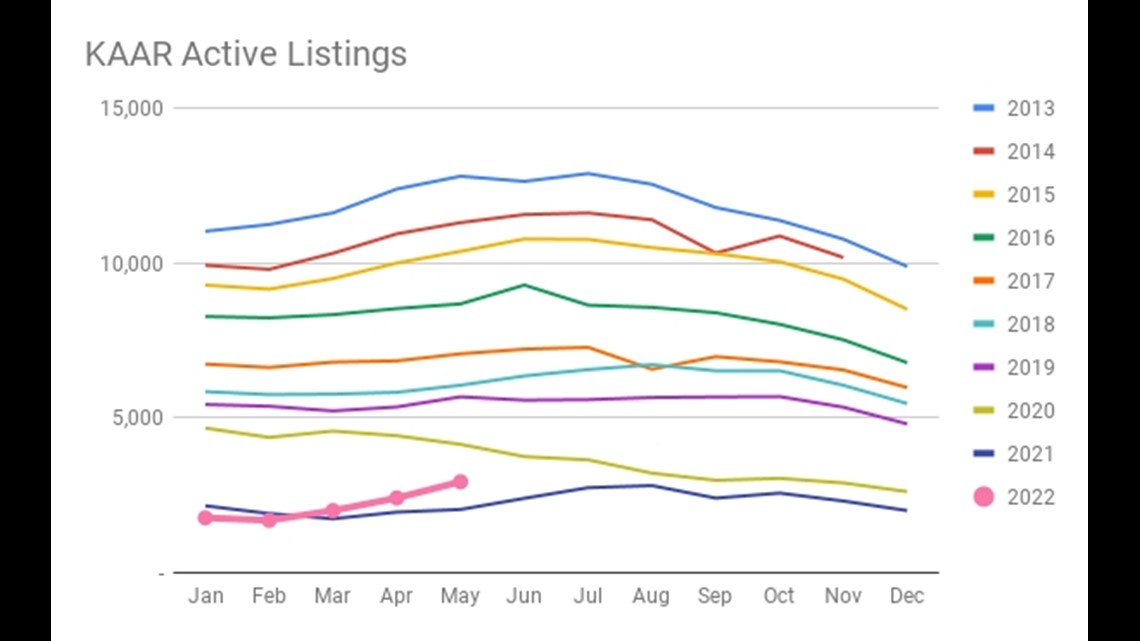

Suzy Trotta is a realtor who writes regularly about the city's real estate. She said the number of listings was up in May compared to last year and compared to April 2022. It was the third time in a row that the number of listings increased.

She said the number of active listings was actually the highest they had ever been since October 2020 — but still far below what they were in the years before that. She said if there were no more listings, it would take around a month and a half to sell everything on Knoxville's housing market.

That's a slight increase of around half a month compared to previous housing market reports. A housing market is usually considered healthy if it takes around six months to sell everything on it.

"When I get excited about almost a half-month increase in supply, that's how low supply has been," said Trotta. "If we can get to two months, if we can get to three months, I think that would be great for the health of our housing market ... It's going to seem like we're flooded with houses if we get to six months because we're so used to this being our new normal."

Trotta also warned that the rate prices are rising is not slowing down. She said the price of an average three-bedroom home increased by around $13,000 compared to April and now costs around $361,000 in Knoxville.

"I think this summer, now that we're officially in the summer selling season, will be very telling about pricing. We don't have any data on that year, of course, but I don't see prices going back down to where they were pre-pandemic before all of this started," Trotta said.

She also said the housing market still hasn't seen the impact of rising interest rates. However, Trotta also emphasized that the interest rates affecting the cost of mortgages are historically still low. She said they stayed under 6% for several years following the housing market bubble of 2008, and now were rising back up to historical norms.

She also said there is a good chance they may fall back down in the future.

"We have so much pent-up demand for housing from the last 2 years, people who dropped out of the market who are coming back in now," she said. "Maybe they've lowered their price point because interest rates are a little higher, but they're back out looking. They feel comfortable looking, that they won't be in a multiple-offer situation or maybe only two or three offers. Not 25 offers."

She said healthy appreciation on the price of homes would have been around 5% per year. But now, she said some homes have sold with a 20% profit after they were sold the year before.

"That is not a healthy market. I mean, it's great for those people, but it's not great for the market, in general. And that's the inflation we're trying to curb with the interest rates," she said. "As far as buying goes, yes, prices are high and interest rates are a little high, but rent is also incredibly high. And the stories I've been hearing about trying to find a rental, some people are still choosing to buy rather than rent."