KNOXVILLE, Tenn. — Sellers are searching for buyers of more homes, helping alleviate some of the pressure on Knoxville's real estate market that pushed prices sky-high in recent years.

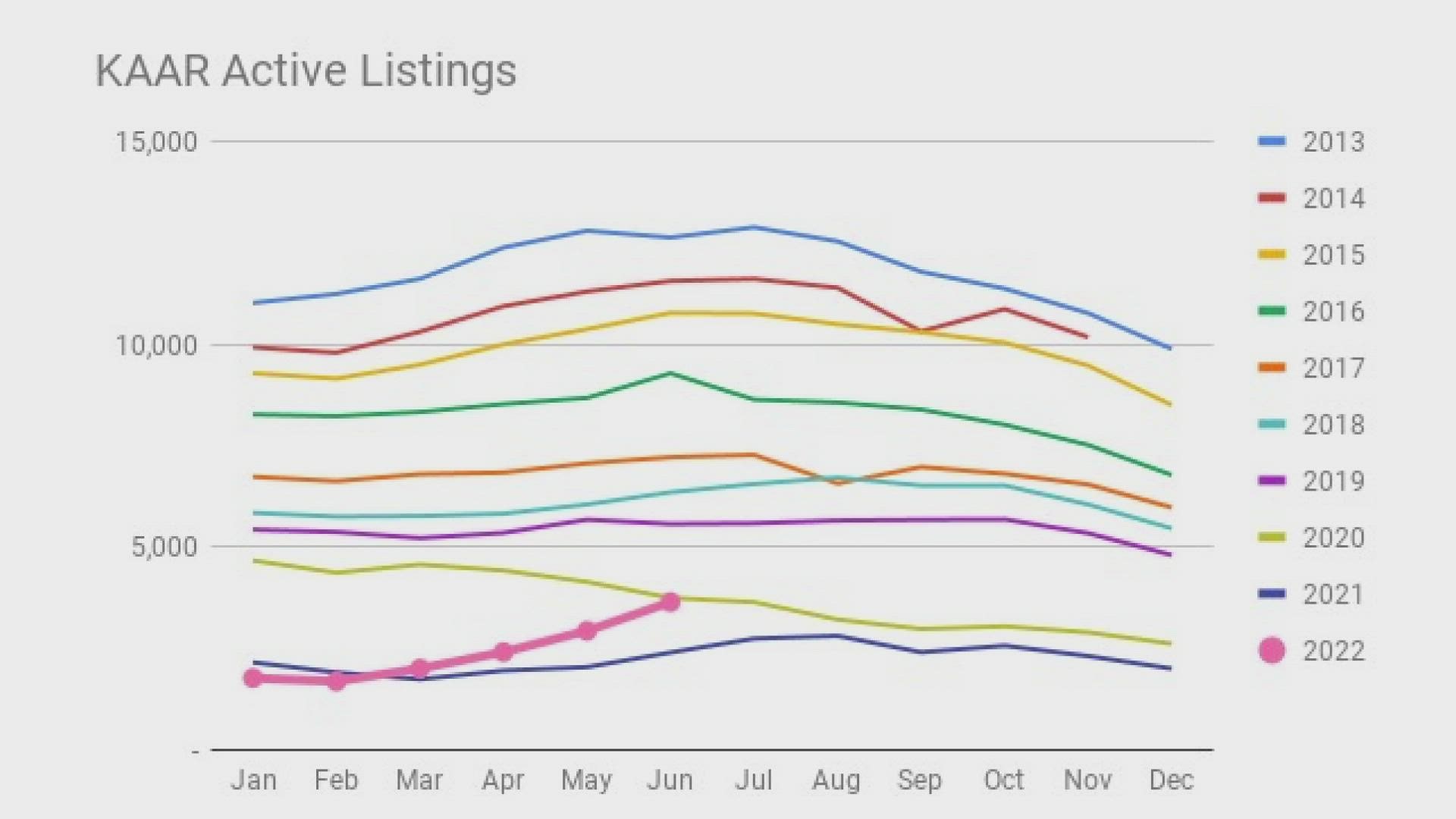

Suzy Trotta, Knoxville real estate expert, wrote that the number of active listings is approaching 2020 levels for the first time in more than 2 years. She said that if homes stopped being listed in Knoxville, it would take around 1.66 months to sell all of what is currently listed.

Around a year ago, it would only take a month. In a healthy housing market, Trotta said there would be six months of houses up for sale.

"That is improvement," she said. "Anything we can get to alleviate the bottleneck in the supply market is positive. Even if it's just a half month's supply, I'll take it."

The number of homes that buyers closed on also rose in June, according to her data. They are still slightly below the number of homes that were sold in June 2021.

Although there are small signs of improvement, the average price of a three-bedroom home in Knoxville still remained high. It almost exactly matched the price it was last month — $361,384. In 2021, the average price was around $289,200. Trotta wrote that around 29% of June home sales were also paid for with cash, typically used by large investment companies.

If more cash sales are used in a market, it becomes more challenging for average buyers who finance homes with mortgages.

"One thing we're seeing more often, and this is a national trend, is buyers walking away from deals for legitimate reasons," she said. "I think sellers definitely are still not willing to do any kind of repairs on a house, almost. So if you're paying top dollar with no repairs, at a higher interest rate — you might look at walking away."

Interest rates rose since last month, now between 5% and 6%. Trotta emphasized that although the rates are higher, they are still historically low compared to eras like the Reagan administration when they reached more than 13%.

"There's nothing else that you can borrow money for at that low of a rate. Not cars, not your credit card, anything. We call it free money as realtors," she said. "We're not sure yet what's going to happen with the latest Fed rate hike that happened yesterday. But I would imagine that rates are going to go up a little bit, and then come back down after the market has a chance to react to them."