KNOXVILLE, Tenn. — Senior homeowners in Knox County may be able to effectively freeze their property tax rate, guaranteeing they won't need to pay more money if the value of their home ever changes.

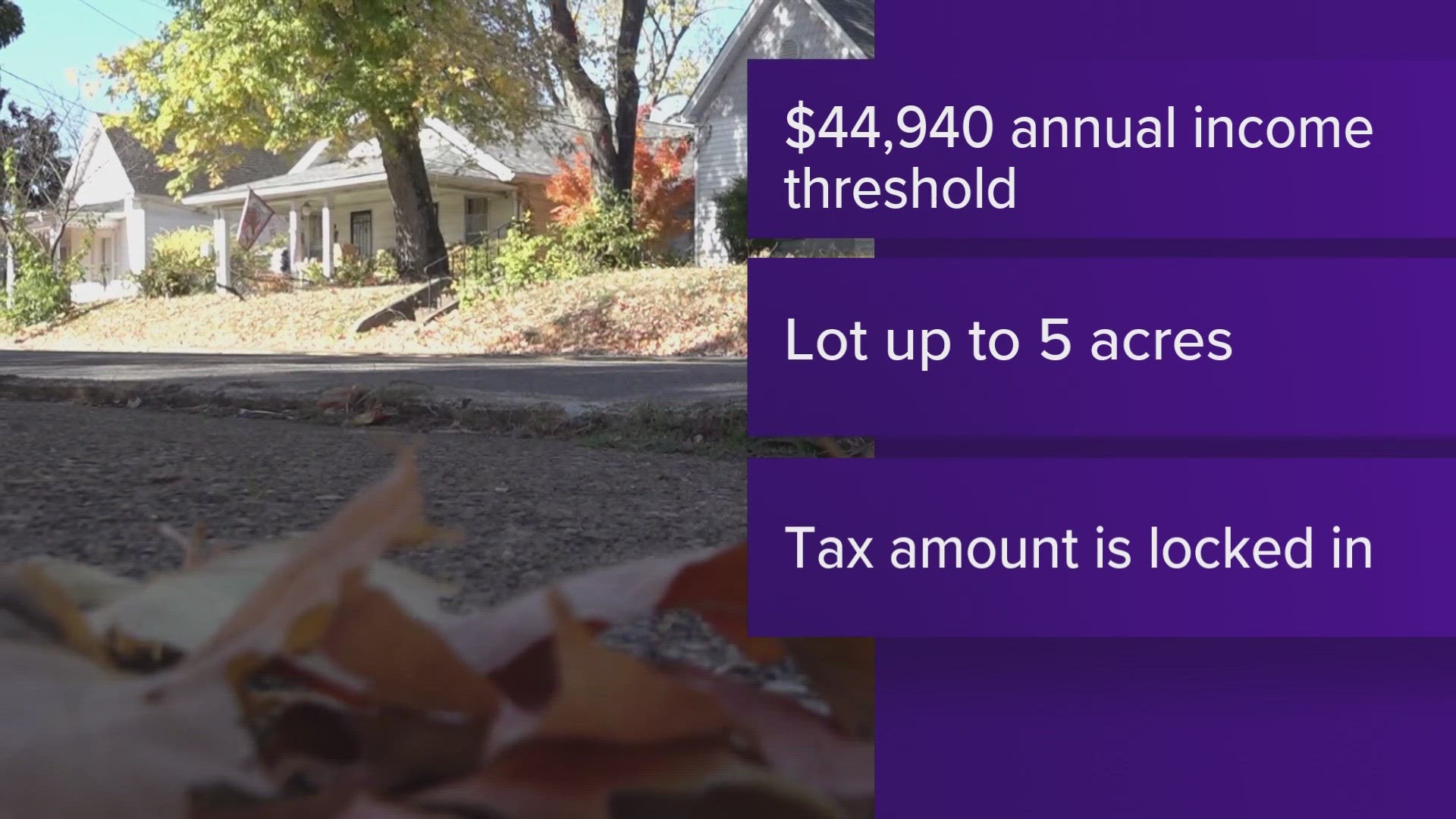

The county offers the tax freeze to homeowners who are 65 years old or older, and whose incomes also do not exceed $44,910 per year. In 2024, that amount is expected to increase to $60,000 per year. While assessors can still change the appraisal and assessment value of their homes in subsequent years, seniors will not need to pay more as a result of those changes.

If their property taxes decrease, the frozen base amount will also decrease.

"What tax freeze does and why's so attractive to so many people is because the tax freeze program freezes your taxes at that specific tax rate," said Justin Biggs, the Knox County Trustee.

Other tax relief programs include one for disabled veterans, widows and widowers. Through the program, veterans with an honorable discharge may be able to get $680 in tax relief. There is no income limit for the program.

A similar program offers disabled homeowners and elderly homeowners who are 65 years old or older $120 in tax relief, as long as their income does not exceed $33,460 per year.

"It's something that we've been told multiple times by different people, you know, 'It was the difference on me buying Christmas presents or my meds, and then we got to sign up for this program, and we can do both,'" said Biggs.

Anyone who thinks they are eligible for a tax relief program can reach out to the Knox County Trustee by calling 865-215-2305. More information about the programs is also available on the Trustee's website.