East Tennessee nonprofits are voicing concerns over the GOP tax bill and how it could negatively impact charitable giving.

While many nonprofit leaders say they wouldn't normally take a stance on legislation, they said this is one issue that will affect millions of people in need who rely on their services.

"We're still holding our breath on how this will go," said Ben Landers, the president of United Way of Greater Knoxville.

Landers and other charity leaders say the GOP tax bill would weaken the charitable deduction, because the new higher standard deduction eliminates the financial incentive for families to itemize deductions, including charitable donations.

"Most of our research indicates that people will still give but they might not give as much, so there's a lot of nervousness about what that, what that could mean," Landers said.

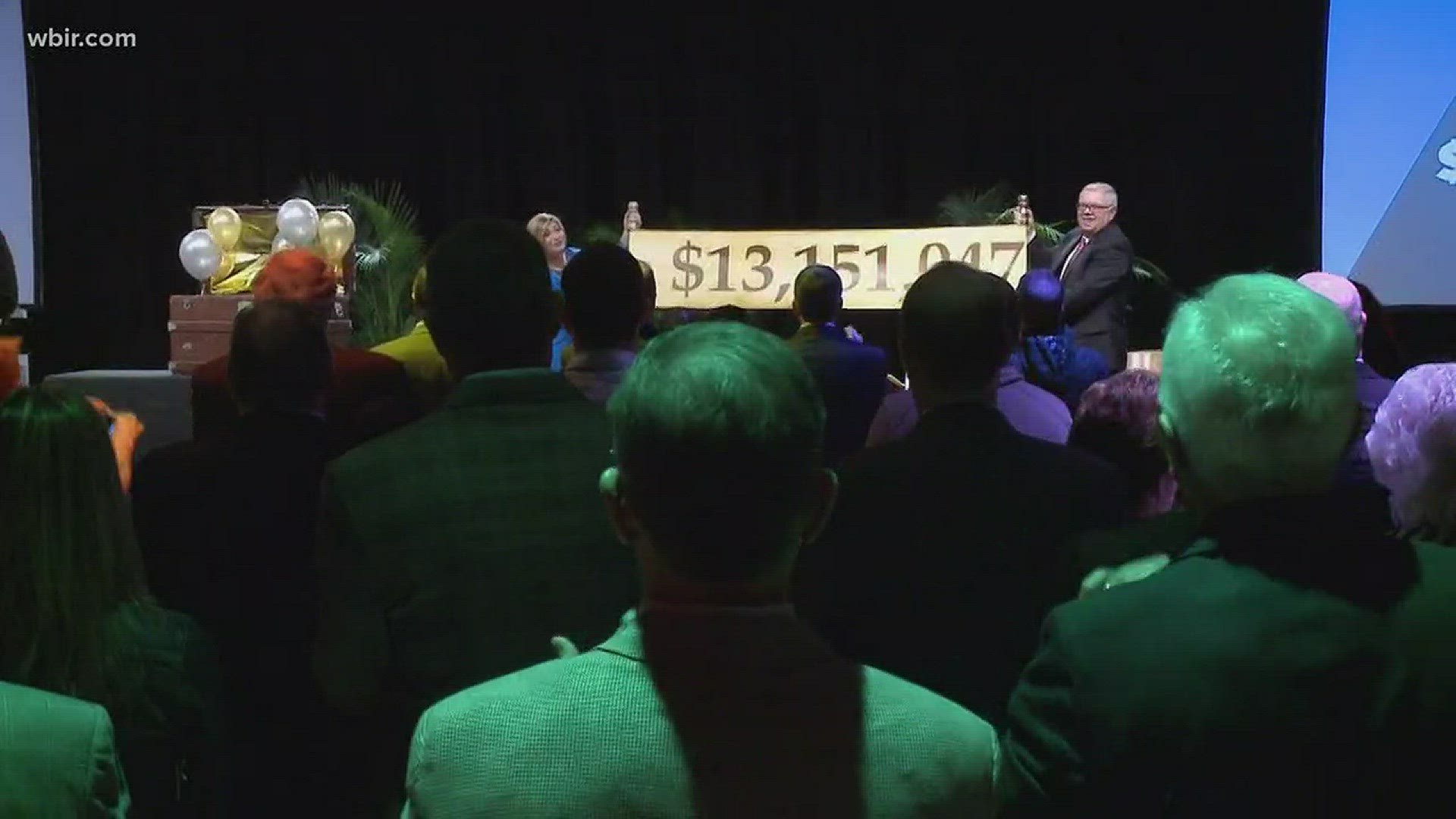

NBC News reports 28 million fewer Americans could itemize their deductions under the GOP tax plan. The National Council of Nonprofits believes this could lead to a $13 billion drop each year in charitable donations.

Michael McClamroch, president and CEO of the East Tennessee Foundation, said this could have a major impact on nonprofits' bottom line.

"We are creating what we consider the perfect storm, government cuts that will ensue as the deficit increases at the same time we're reducing incentives to give to nonprofits," he said.

McClamroch said it's not a partisan issue for nonprofits, but a policy issue - one that could affect donations year-over-year, and the people who benefit from them.

"I just don't think it makes good sense to reduce the incentive to that vast charitable infrastructure that we've built up in the last 100 years in the United States right at the time we're going to need them most," he said.

The East Tennessee Foundation said it is seeing a burst of year-end giving. McClamroch attributes this to people's certainty in the tax law now, and the question mark about its future.